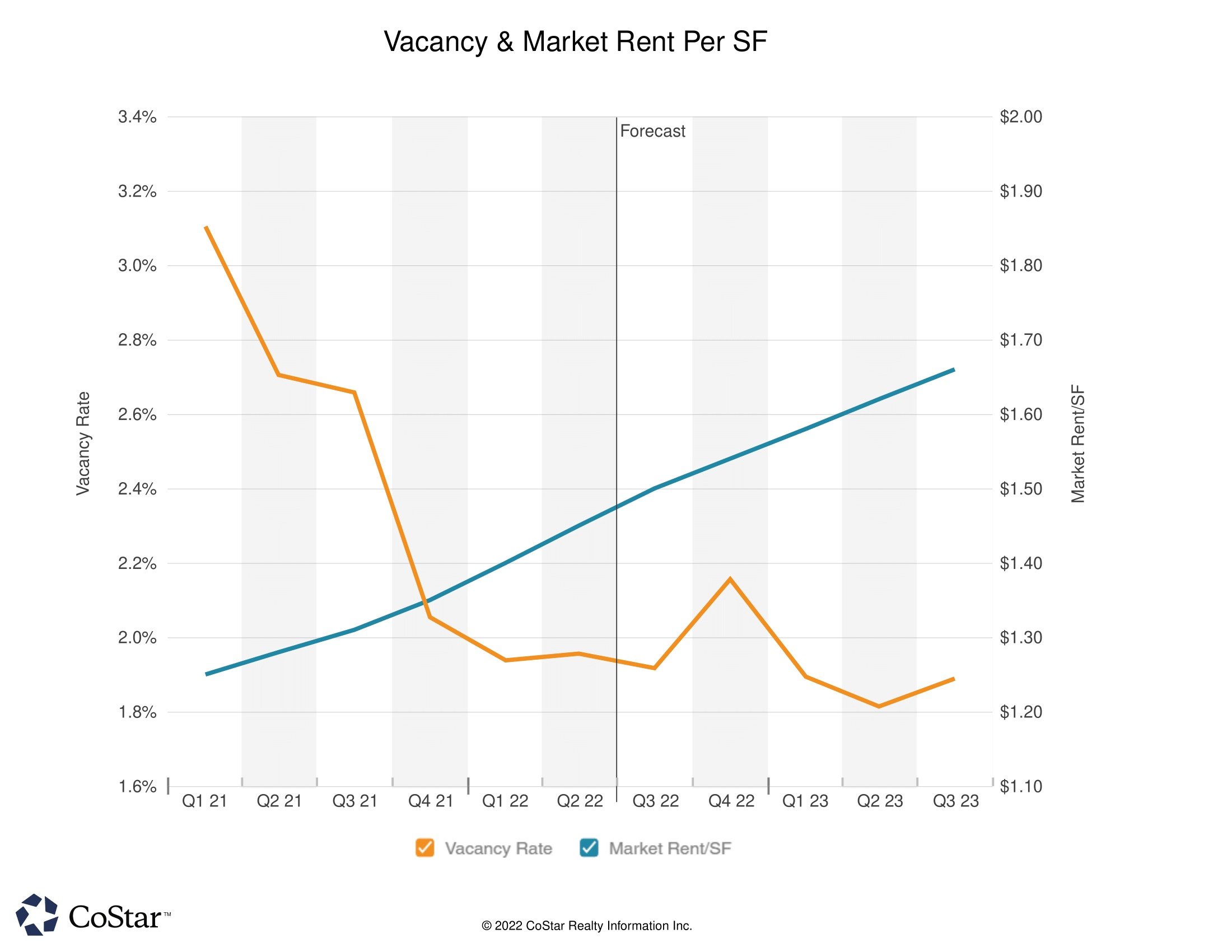

Three quarters of 2022 saw lowered vacancy and increased asking rent for industrial listings compared to previous quarters. With an average vacancy of less than 2% and an average monthly rent of $1.45/SF, Orange County’s industrial market remains among the most competitive commercial markets compared to Los Angeles and the Inland Empire (CoStar).

This trend is expected to continue while demand for industrial property remains elevated despite the drastic decline in available space. What does this entail for prospective tenants seeking a space for their business? Our brokers at Aspect Real Estate Partners can help you navigate through some of the challenges of finding industrial property.

High demand drives new construction

Demand for industrial space remains elevated due to Orange County’s proximity to ports in Los Angeles. As a result, the industrial market in Orange County is a hot-spot for distribution companies, contractors, and service-type industries (REBusiness). While distribution companies utilize the space to store and deliver products that they own or buy from other companies, contractors and service-type industries often occupy the space with vehicles.

Still, most of the demand is now being driven by e-commerce, likely due to the coronavirus pandemic forcing retailers to transition online. As available sale and lease listings are continually declining, developers are compelled to construct more warehouses, even going as far as to convert office or retail buildings into industrial spaces to mitigate demand. Warehouse construction in Orange County is up 478% compared to Q1 in 2021 and will be expected to follow this upwards trend if demand remains high (AIRECRE). As a result, some construction projects are pre-leased to occupants before even being built.

Increasing asking rents driven by demand

The high demand of industrial spaces consequently drive up asking rents as well. Orange County currently sits at an average market rent of $1.49/SF in Q3 of 2022 (CoStar). Market rent is projected to increase steadily, possibly sitting at an average of $1.70/SF by Q3 of next year (CoStar).

Nonetheless, Orange County houses a lot of the older, more affordable industrial buildings compared to the Inland Empire, which has newer inventory. Many of these older buildings are manufacturing sites which smaller tenants may find appealing for their business (REBusiness). Even so, for prospective tenants and buyers, it is important that you have the appropriate financials and creditworthiness before seeking a space.

Figure 1. Historic and Projected Vacancy and Market Rent per Square Foot. The vacancy rate for industrial properties in Orange County continue to trend downwards and is projected to hover at 1.9% by the end of 2023. On the other hand, market rent per square foot follows a linear increase, with a forecasted rent of $1.70/SF by the end of 2023.

Vacancy rates trend downwards

In an already tight market of high demand and high asking rents, industrial vacancies in Orange County remain competitively low due to its affordability when compared to Los Angeles. Additionally, the Inland Empire tries to mitigate industrial demand by adding more inventory, yet with over 20 million SF still under construction (compared to Orange County’s 3 million), Orange County may not see any respite soon (AirCRE). Vacancy is currently at an average of 1.89%, a record low in over 15 years (CoStar). And while it may prove challenging to find available industrial space, having strong financials and remaining flexible in the location puts you at an advantage to secure a space.

Picky property use obstructs new tenants

One the largest challenges for perusing industrial tenants, apart from the historically low vacancy and high asking rent, is seeking a property with a suitable use-case for your business. Industrial landlords remain firm in their use-cases, often making it hard to find spaces not used strictly for storage, distribution, or manufacturing. For example, our clients Malaia’s Microgreens needed an industrial space to run their hydroponic farming business. Since their business did not strictly fall under manufacturing, it was difficult to find spaces that approved of their property use-case. However, with a broker to represent them amidst a competitive market, seeking and negotiating the right lease helped them reach success. Read more about Malaia’s Microgreens case study here.

To prospective tenants

Now how do prospective tenants navigate finding a property given these trends in the industrial market?

Firstly, it is essential that tenants come in with strong financials to put them in a more favorable position for landlords who may be evaluating multiple tenants. Additionally, consider if your business can run in an office or retail space, both of which have higher vacancies and therefore, more options. The upwards trend in asking rent for direct leases may discourage some, but the trend in asking rents for subleasing appears to be plateauing, remaining around $1.35/SF over the past year (AirCRE). Lastly, to mitigate the challenges of finding a property in a market of low vacancies, give yourself ample time to find a space for your business. Properties often become available for brokers to see before the public can, and with timely negotiations, you may be able to commit to your ideal space.

Overall, our team at Aspect Real Estate help our clients understand the challenges of finding the appropriate property while diligently representing the most of their business needs. If you are interested in seeking a commercial space, our associates would love to find you the right property that would help you and your business grow.

References

- Daniels, Sarah. “Growing Southern California industrial demand creates shifts in strategy, outlook.” REBusinessOnline, 5 Aug. 2022, https://rebusinessonline.com/lee-associates-growing-southern-california-industrial-demand-creates-shifts-in-strategy-outlook/.

- Ebel, Monique. “Q2 2022 Research Report - Air Cre.” Air CRE, 8 Aug. 2022, https://www.aircre.com/site/wp-content/uploads/2022/08/AIR-CRE_Q2-2022-Research-Report_08-04-2022.pdf.

- Ohl, Joshua. “As Orange County’s Industrial Vacancy Rate Falls, So Does Leasing.” CoStar, 5 Aug. 2022, https://www.costar.com/article/189545275/as-orange-countys-industrial-vacancy-rate-falls-so-does-leasing.